The Growing Threat of Invoice Fraud

Invoice fraud is one of the most prevalent and costly issues facing finance teams today. As businesses become more digital, fraudsters are finding new ways to exploit vulnerabilities in manual accounts payable (AP) processes. These fraudulent activities not only affect cash flow but also create significant compliance and operational risks. In this article, we will discuss how automation tools like AP Flow can help detect, prevent, and mitigate invoice fraud in real time, reducing the risk of costly mistakes and protecting your financial integrity.

The Problem of Invoice Fraud

Invoice fraud can take many forms, including fake invoices, altered details, and duplicate payments. Manual AP processes struggle to detect these issues quickly, leading to significant financial losses, damaged supplier relationships, and potential compliance risks.

In fact, many of these challenges are covered in detail in our blog on common AP errors in invoice processing, which highlights how easily such mistakes can slip through without the right safeguards.

That’s where automation helps—by enabling real-time fraud detection and flagging suspicious activities before they impact your bottom line.

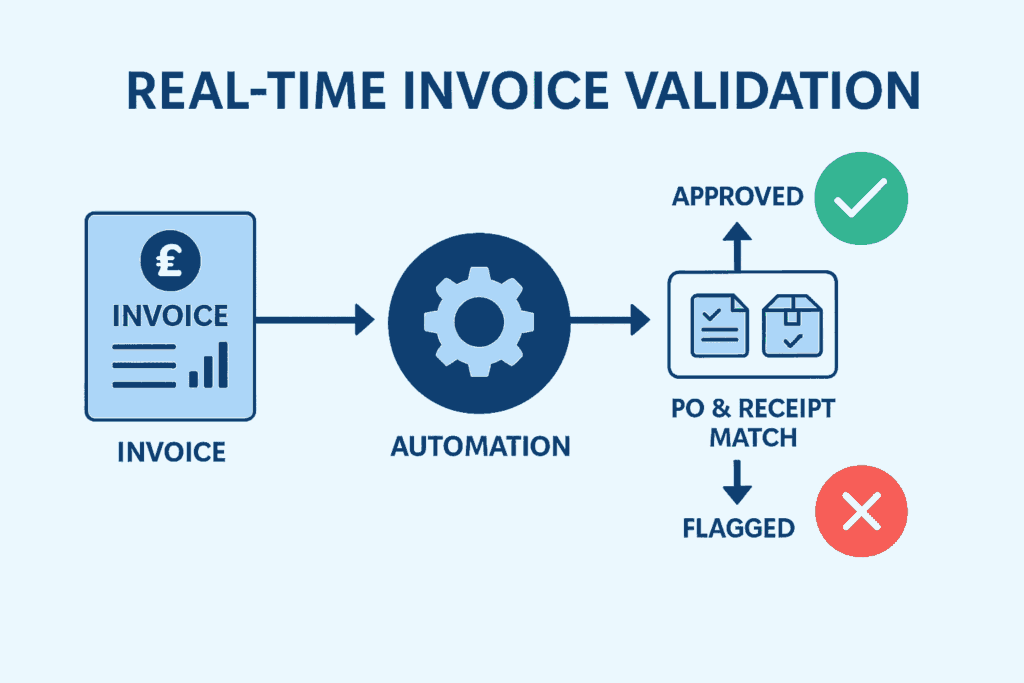

Real-Time Invoice Validation

Automated systems validate invoices in real time, ensuring they match with purchase orders (POs) and delivery receipts instantly. This eliminates delays found in manual systems and prevents fraudulent invoices from being processed. The automation provides immediate visibility, allowing teams to act fast and catch mistakes before payments are made.

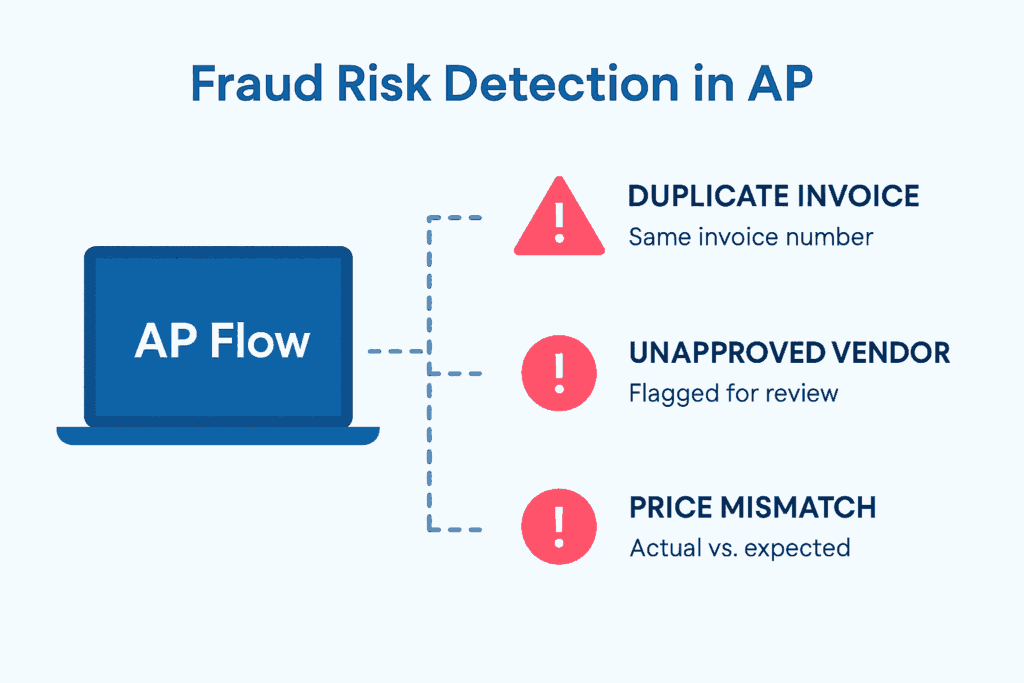

One of the most powerful features of AP automation is fraud risk detection. With tools like AP Flow’s Fraud Risk Detection, suspicious activities such as duplicate invoices, unapproved vendors, and pricing discrepancies are flagged immediately. These tools analyse invoice data against predefined rules and historical patterns, identifying unusual behaviour that may indicate fraud. Alerts are triggered in real time, allowing finance teams to review and investigate before payments are processed. This proactive approach ensures that fraudulent activities are caught early, reducing the risk of financial loss and reputational damage.

The Role of AI in Preventing Invoice Fraud

AI plays a critical role in preventing invoice fraud. By analysing large amounts of data, AI identifies unusual patterns, such as invoices from suspicious vendors or discrepancies in tax details. Unlike manual checks, AI-driven fraud detection is proactive, improving over time and catching issues before they escalate.

Integration of AP Automation with Existing Systems

For AP automation to be effective, it needs to integrate seamlessly with existing financial systems like Enterprise Resource Planning (ERP) platforms (e.g., Microsoft Dynamics, SAP). This integration ensures that all data — from procurement to payments — is connected and accessible in one centralised system. By having a unified platform, finance teams can access real-time financial data, track transactions more accurately, and maintain better control over procurement processes. This integrated approach not only reduces fraud risks but also streamlines operations, improves collaboration, and ensures greater accuracy in financial reporting and audit trails.

Benefits of AP Automation for Fraud Prevention

The benefits of AP automation go far beyond efficiency — they directly impact fraud prevention. By eliminating manual errors, providing real-time data, and automating fraud detection, AP automation significantly reduces the risk of fraudulent activity. Automation tools like Medius Copilot offer features such as predictive analytics, AI-driven alerts, and streamlined workflows, allowing teams to make faster, more informed decisions. These tools also create a more transparent and reliable system, improving compliance and enabling finance teams to focus on strategic tasks instead of fighting fraud.

Why AP Automation is Essential for Fraud Prevention

Invoice fraud remains one of the greatest challenges for finance teams, but with AP automation, companies can safeguard against fraud more effectively. By providing real-time validation, AI-driven fraud detection, and seamless integration with existing systems, AP automation protects your bottom line and ensures more accurate, efficient processes. If you’re looking to strengthen fraud protection, streamline your workflows, and improve financial control, adopting AP automation is the best step forward.

Ready to Secure Your AP Processes and Prevent Fraud?

If you want to protect your margins and streamline your workflows, get in touch with us today to learn how AP automation can transform your operations and safeguard against fraud.