Gain instant control over costs, eliminate inefficiencies, and drive smarter decisions — all in real time. Discover how to get gross profit by using automation to transform financial visibility into profitability.

Profitability Needs More Than Just Revenue

Gross profit reflects operational efficiency, not just sales. But many finance teams still rely on outdated reports, manual workflows, and scattered communication — leading to hidden costs and missed savings.

If you’re wondering how to get gross profit without just increasing revenue, The solution? Automation and real-time visibility. By digitizing your procure-to-pay (P2P) process, you can reduce inefficiencies, prevent fraud, and make faster, smarter decisions. In this blog, we’ll explore how AP Flow — in partnership with Medius Copilot — helps you protect and grow your margins.

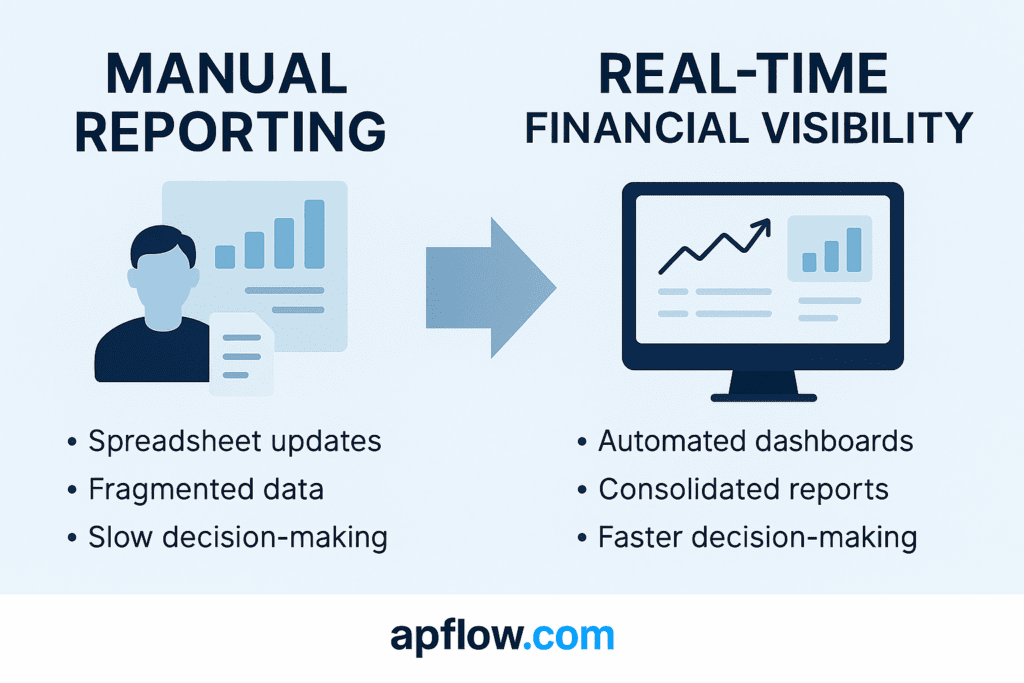

What Is Real-Time Financial Visibility?

Real-time financial visibility gives your team instant access to key data — from spend and supplier activity to invoice status and fraud alerts.

📈 Why it impacts gross profit:

- Catch costly errors early

- Prevent duplicate or overpaid invoices

- Uncover real-time savings

- Make faster, data-backed decisions

This isn’t just better reporting — it’s strategic control.

Medius Copilot: Visibility That Drives Action

Medius Copilot connects your entire P2P ecosystem and delivers:

- Live dashboards with spend insights

- AI-powered anomaly detection

- Real-time collaboration across finance and procurement

With Medius Copilot, you don’t just collect data — you act on it to protect profit.

How Automation Helps Improve Gross Profit

Manual AP and procurement processes often hide costly issues:

- Duplicate or inflated payments

- Delayed approvals and missed discounts

- Data entry errors and mismatches

- Fraud that slips through unnoticed

These inefficiencies silently drain margin.

Automation Closes the Leaks

With AP automation, you can:

- Auto-match POs, invoices, and receipts

- Flag duplicates and pricing issues instantly

- Route approvals based on logic, not inboxes

- Track real-time spend against budget

✅ Every streamlined step reduces overhead — and protects profit.

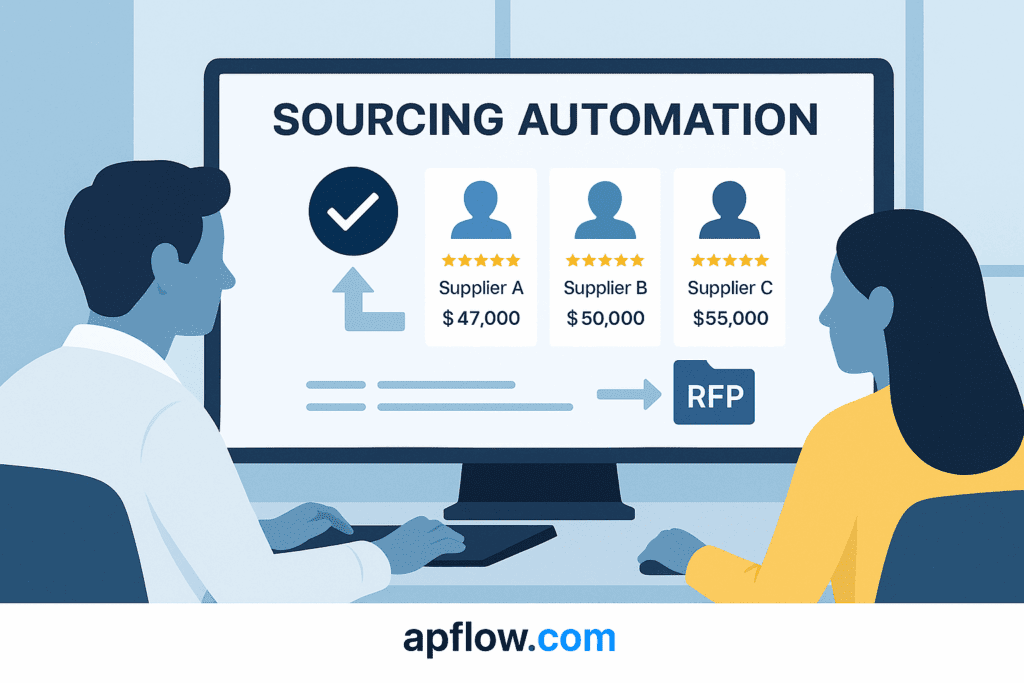

Sourcing Automation: Driving Smart Supplier Deals

One of the fastest ways to improve gross profit? Fix how you source.

Manual sourcing leads to:

- Overpriced supplier contracts

- Missed discounts and slow RFP cycles

- Limited visibility into better vendors

⚡ Automation = Smarter Sourcing

With AP Flow’s sourcing module, procurement teams gain:

- Centralized supplier data and side-by-side comparisons

- Faster, automated RFP creation and scoring

- AI-driven vendor recommendations

- Consistent, auditable workflows

✅ Result: You negotiate better, move faster, and pay less — boosting gross profit before a single invoice is paid.

Supplier Conversations That Drive Profitability

Profitability isn’t just about what you buy — it’s about how you manage supplier relationships.

Communication gaps lead to:

- Delayed shipments from unpaid invoices

- Duplicated orders due to status confusion

- Missed early payment discounts

- Poor supplier experience and compliance

Automating Supplier Communication

With automation, supplier conversations become:

- Centralized and trackable in one platform

- Triggered automatically based on invoice or PO status

- Documented and auditable

- Proactive — with alerts, reminders, and milestone tracking

AP Flow’s Supplier Conversations module ensures every conversation supports your profit goals — not delays them.

✅ Faster responses. Fewer disputes. Smarter cost control.

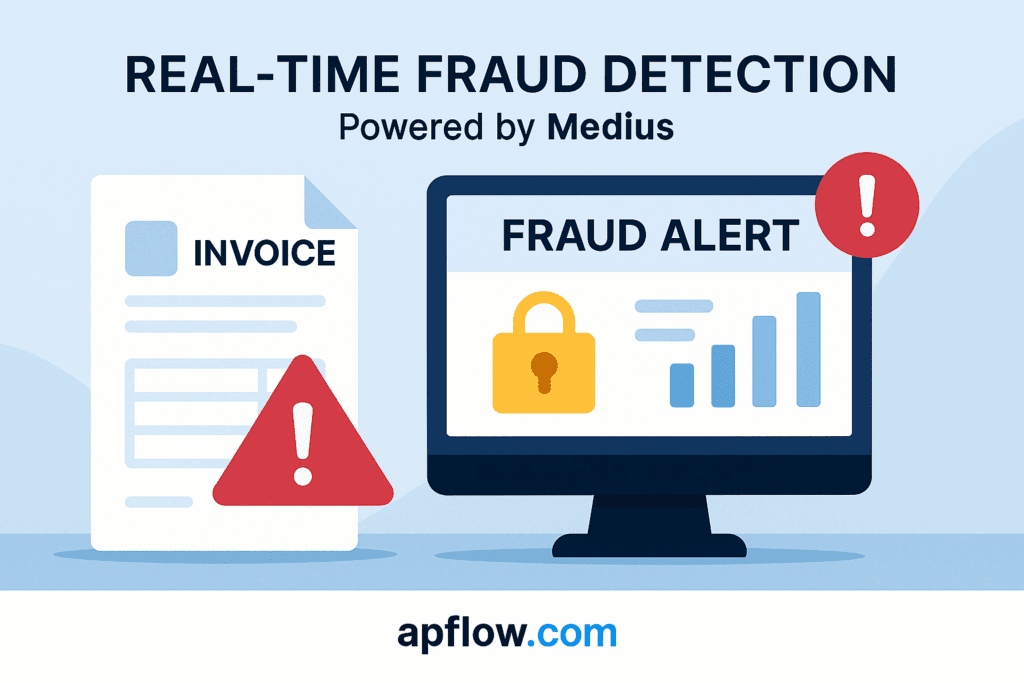

Fraud and Errors: The Hidden Profit Killers

Common AP leak points:

- Duplicate vendor payments

- Invoices without POs

- Fake supplier setups

Manual entry errors (e.g., wrong currency)

Companies lose 0.1–0.5% of spend annually to AP error or fraud. That’s up to $500,000 for every $100M in spend.

Stop Losses Before They Start.

AP Flow’s Fraud Risk Detection, powered by Medius, helps:

- Spot suspicious patterns

- Flag entries outside contract terms

- Alert teams before payouts

- Auto-block fake or duplicate vendors

✅ Cleaner audits. Fewer losses. More margin retained.

Real-Time Dashboards & Reporting: Visibility in Action

Automation means nothing without visibility. Real-time dashboards help:

- Monitor spend trends

- Spot risks early

- Make faster, profit-saving decisions

Medius Copilot: Real-Time Financial Intelligence

Medius Copilot isn’t just a dashboard — it’s an AI-powered engine that delivers:

- Spend analytics by vendor, region, category

- Predictive insights for savings

- Alerts for fraud or bottlenecks

- ERP integration (Microsoft Dynamics, SAP)

✅ Smarter decisions. Faster actions. Better margins.

Profitability Starts with Visibility

In today’s market, profitable growth comes from smarter spending not just more sales. If you’re exploring how to get gross profit through better financial control AP Flow, powered by Medius Copilot, gives you real-time control across sourcing, supplier conversations, invoice validation, and fraud detection.

✅ Stronger visibility. Tighter controls. Better profit.

Ready to Find Your Hidden Profit?

Let’s turn your AP and sourcing data into actionable insights that protect and grow your margins.

👉 Want to talk to an expert? Contact our team and start your journey toward smarter spend management.