E-invoicing isn’t just a trend—it’s becoming law across the globe. As governments digitize their tax systems, businesses must shift from traditional invoicing to real-time, validated digital invoices.

Why E-Invoicing Is Becoming Mandatory Globally

E-invoicing helps:

✅ Improve tax collection

✅ Reduce VAT/GST fraud

✅ Automate auditing and reporting

✅ Ensure transparency in B2B and B2G workflows

Whether you’re a multinational enterprise or an SME, adapting to e-invoicing is no longer a nice-to-have—it’s a compliance necessity. It also improves internal efficiency by minimizing paper handling, human errors, and delayed payments.

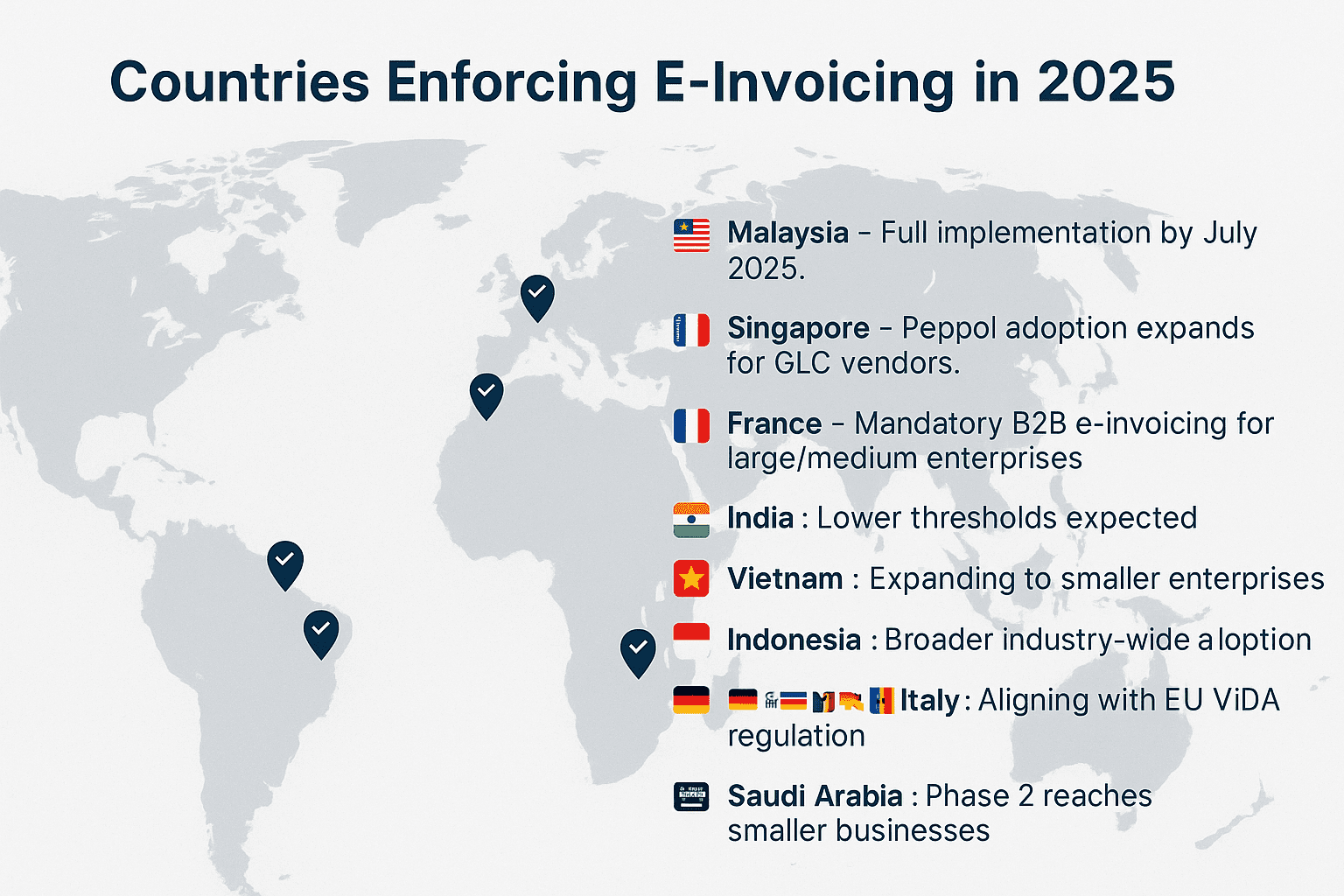

📊 Countries Enforcing E-Invoicing in 2025:

🇲🇾 Malaysia – Full implementation by July 2025

🇸🇬 Singapore – Peppol adoption expands for GLC vendors

🇫🇷 France – Mandatory B2B e-invoicing for large/medium enterprises

🇮🇳 India – Lower thresholds expected

🇻🇳 Vietnam – Expanding to smaller enterprises

🇮🇩 Indonesia – Broader industry-wide adoption

🇩🇪🇮🇹 Germany & Italy – Aligning with EU ViDA regulation

🇸🇦 Saudi Arabia – Phase 2 reaches smaller businesses

💡 Pro Tip: Each country has unique rules and formats. Choose an AP automation platform that’s agile, compliant, and cross-border ready.

🇲🇾 Malaysia’s E-Invoicing Rollout

Malaysia’s LHDN (Inland Revenue Board) has announced a clear compliance timeline:

📅 August 2024 – > RM100 million turnover

📅 January 2025 – > RM50 million turnover

📅 July 2025 – Mandatory for all businesses

To comply businesses must:

🔹 Connect to MyInvois platform

🔹 Use LHDN-approved formats

🔹 Ditch manual/PDF invoices—they won’t be valid

For finance leaders, this means upgrading internal processes and working closely with IT teams to ensure integration with LHDN APIs. A delay in readiness could lead to reporting errors or non-compliance penalties.

✔️ AP Flow’s Malaysia-ready integrations ensure smooth onboarding and real-time validation.

🇸🇬 Singapore’s Peppol Adoption Journey

Singapore is a regional leader in Peppol-based e-invoicing, championed by IMDA.

Benefits of Peppol E-Invoicing:

🔗 Peppol = secure, cross-border invoicing

⚙️ Faster processing, fewer manual errors

🚀 Strong adoption among GLCs & public sector vendors

Even though e-invoicing isn’t yet fully mandatory, its adoption is accelerating across industries including finance, logistics, and manufacturing. Businesses adopting Peppol early position themselves as digitally mature and government-ready.

AP Flow supports Peppol-ready formats and Microsoft Dynamics integration—perfect for Singapore-based digital-first companies.

Challenges of Multi-Country Compliance

If your business spans multiple jurisdictions, e-invoicing compliance becomes tricky.

Key challenges:

❗ Changing laws across borders

❗ Real-time integration with different tax systems

❗ Varied invoice formats (XML, JSON, etc.)

❗ Training finance teams in multiple regions

In addition, country-specific mandates often come with tight deadlines, limited testing environments, and mandatory digital signatures. Navigating all this manually can increase risk and workload for already stretched finance teams.

🛡️ Why Choose AP Flow for Global E-Invoicing?

AP Flow is designed to keep you automated, compliant, and future-ready.

✅ Supports compliance in 10+ countries

✅ Built for Peppol and LHDN standards

✅ Integrates with ERPs like Microsoft Dynamics & SAP

✅ Microsoft-recognized and featured in Gartner Magic Quadrant

Related AP Flow Resources:

- Fraud Risk Detection in P2P Processes

- Bank & Credit Card Reconciliation Services

- Financial Consolidation Services

With localized rule engines and flexible configuration, AP Flow ensures your business can comply without disrupting day-to-day workflows.

✅ Final Word: 2025 Is the Year to Prepare

The global shift toward e-invoicing is not optional—it’s happening. Whether you’re in Malaysia, France, or Singapore, the time to act is now.

With AP Flow, you can:

🚀 Reduce risks

🛠️ Automate compliance

🔍 Avoid fines and stay audit-ready

The sooner you begin preparing, the more confidently you can meet the mandates—and set up your finance team for long-term digital success.

📞 Book Your Free E-Invoicing Audit

Let us help you simplify compliance and take the guesswork out of mandates.